All Categories

Featured

Table of Contents

Any type of warranties offered are backed by the economic toughness of the insurer, not an outdoors entity. Investors are warned to very carefully examine an indexed annuity for its features, prices, risks, and how the variables are computed. A set annuity is intended for retirement or other long-term requirements. It is intended for an individual that has sufficient money or other liquid possessions for living costs and other unanticipated emergencies, such as clinical expenses.

Please consider the investment purposes, dangers, charges, and costs thoroughly prior to purchasing Variable Annuities. The syllabus, which includes this and various other info about the variable annuity agreement and the underlying financial investment options, can be gotten from the insurer or your economic professional. Make certain to check out the syllabus thoroughly before deciding whether to spend.

Variable annuity sub-accounts change with adjustments in market problems. The principal might be worth basically than the original quantity spent when the annuity is surrendered.

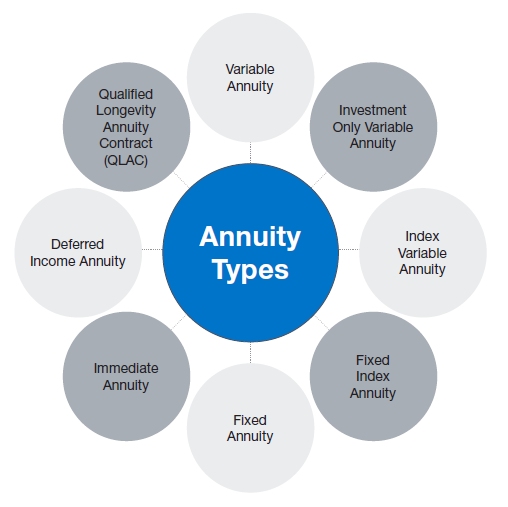

Attempting to make a decision whether an annuity could fit into your economic strategy? Recognizing the various offered annuity choices can be a practical means to begin.

For the preliminary or ongoing premium settlement, the insurance provider commits to particular terms concurred upon in the contract. The simplest of these arrangements is the insurance provider's dedication to giving you with settlements, which can be structured on a month-to-month, quarterly, semi-annual or yearly basis. Conversely, you might choose to forego repayments and enable the annuity to grow tax-deferred, or leave a round figure to a beneficiary.

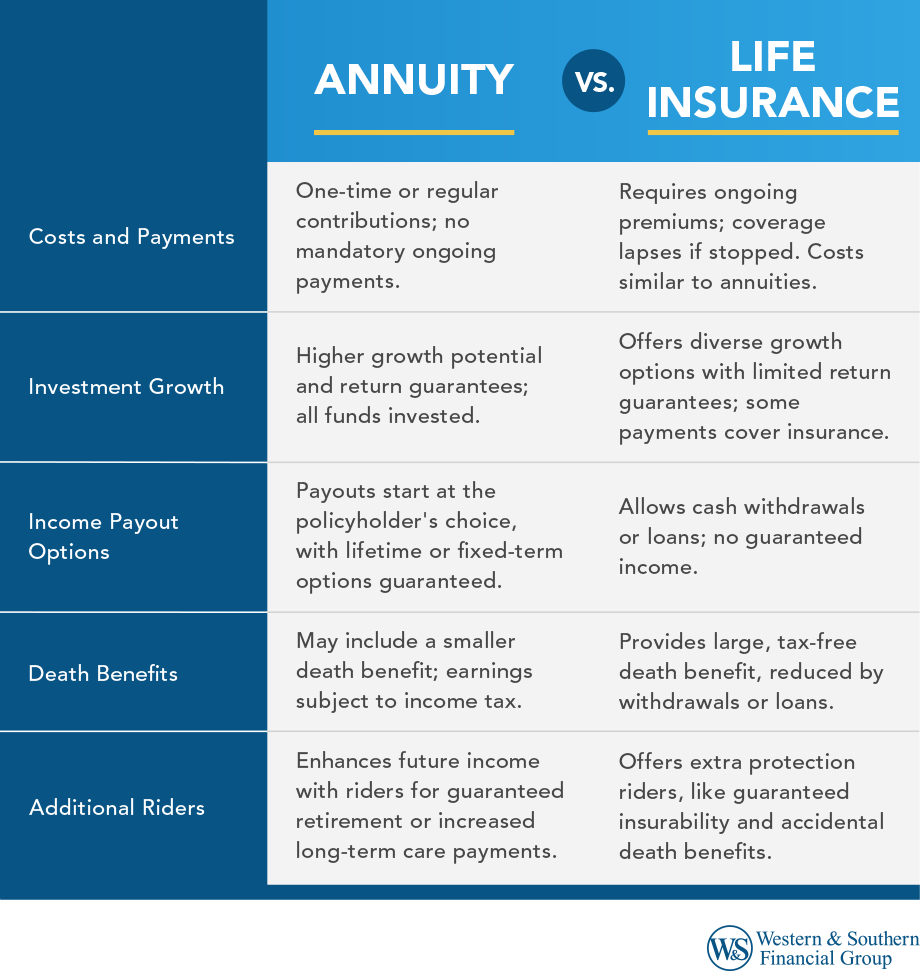

There also might be optional functions (motorcyclists) available to you, such as a boosted survivor benefit or lasting treatment. These arrangements generally have included charges and expenses. Depending upon when they pay out, annuities fall into two main categories: instant and postponed. Immediate annuities can supply you a stream of earnings immediately.

Breaking Down Your Investment Choices A Closer Look at Fixed Annuity Vs Variable Annuity What Is the Best Retirement Option? Advantages and Disadvantages of Annuities Variable Vs Fixed Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: Simplified Key Differences Between Fixed Vs Variable Annuity Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Index Annuity Vs Variable Annuity FAQs About Fixed Annuity Or Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Pros And Cons Of Fixed Annuity And Variable Annuity A Closer Look at Fixed Income Annuity Vs Variable Growth Annuity

When you can manage to wait for a while to receive your payment, a deferred annuity might be a great selection for you. Immediate annuities can provide a routine stream of assured payments that can be structured for the rest of your life. They could even refund any leftover repayments that haven't been made in the event of early fatality.

A life payment uses a payment for your life time (and for your partner's life time, if the insurance firm supplies an item with this alternative). Period particular annuities are just as their name indicates a payout for a set amount of years (e.g., 10 or 20 years).

Additionally, there's sometimes a reimbursement option, a feature that will pay your recipients any type of leftover that hasn't been paid from the preliminary costs. Immediate annuities usually provide the greatest repayments compared to other annuities and can aid attend to an immediate earnings need. There's always the possibility they may not maintain up with rising cost of living, or that the annuity's recipient may not obtain the continuing to be equilibrium if the owner picks the life payout choice and after that passes away too soon.

Understanding Fixed Annuity Vs Equity-linked Variable Annuity Key Insights on Your Financial Future What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Matters for Retirement Planning How to Compare Different Investment Plans: How It Works Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Immediate Fixed Annuity Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Annuities Fixed Vs Variable A Beginner’s Guide to Smart Investment Decisions A Closer Look at Retirement Income Fixed Vs Variable Annuity

Dealt with, variable and set indexed annuities all gather rate of interest in various means. All 3 of these annuity kinds normally offer withdrawals, methodical withdrawals and/or can be established up with an ensured stream of earnings. Maybe the most convenient to recognize, taken care of annuities help you grow your cash due to the fact that they use a fixed passion price (ensured price of return) over a collection period of years.

Rate of interest earned is intensified and can be left in the annuity to proceed to grow or can be taken out after the agreement is annuitized (or possibly during the contract, depending on the insurance policy company). The passion prices used might not maintain up with inflation, and you are committed to them for the set period regardless of financial variations.

Depending upon the efficiency of the annuity's subaccount alternatives, you may get a higher payment as an outcome of that market direct exposure; that's because you're also running the risk of the contributed balance, so there's also a chance of loss. With a variable annuity, you receive every one of the rate of interest credited from the spent subaccount.

Plus, they might also pay a minimal surefire rate of interest, no matter of what occurs in the index. Payments for dealt with indexed annuities can be structured as guaranteed regular payments much like various other kinds of annuities, and interest relies on the regards to your contract and the index to which the cash is linked.

Just repaired indexed annuities have a sweep date, which marks the day when you first begin to take part in the index allotment's efficiency. The sweep date varies by insurance firm, yet usually insurance firms will certainly assign the funds in between one and 22 days after the preliminary investment. With repaired indexed annuities, the crediting duration begins on the move day and commonly lasts from one to three years, depending on what you pick.

For more youthful people, a benefit of annuities is that they supply a method to begin preparing for retirement early. With an understanding of exactly how annuities work, you'll be better outfitted to pick the ideal annuity for your requirements and you'll have a much better understanding of what you can likely expect along the means.

Analyzing Annuity Fixed Vs Variable Key Insights on Indexed Annuity Vs Fixed Annuity What Is the Best Retirement Option? Pros and Cons of Retirement Income Fixed Vs Variable Annuity Why Choosing the Right Financial Strategy Matters for Retirement Planning Annuities Variable Vs Fixed: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Rewards of Fixed Income Annuity Vs Variable Growth Annuity Who Should Consider Variable Vs Fixed Annuity? Tips for Choosing Fixed Vs Variable Annuity Pros And Cons FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

A fixed annuity is a tax-advantaged retired life financial savings alternative that can help to aid construct predictable assets while you're functioning. After that, after you determine to retire, it can create a guaranteed stream of income that could last for the rest of your life. If those advantages interest you, read on to figure out more about: Exactly how fixed annuities workBenefits and drawbacksHow fixed annuities compare to various other types of annuities A fixed annuity is a contract with an insurance provider that is similar in numerous ways to a bank deposit slip.

Usually, the rate of return is ensured for several years, such as five years. After the preliminary guaranteed period, the insurance company will reset the interest price at regular intervals usually yearly but the brand-new price can not be reduced than the assured minimum interest price in the contract.

You don't always need to convert a dealt with annuity into normal revenue payments in retired life. You can select not to annuitize and receive the entire worth of the annuity in one lump-sum settlement. Fixed annuity contracts and terms differ by supplier, yet various other payout options typically consist of: Duration specific: You obtain routine (e.g., month-to-month or quarterly) ensured payments for a fixed period of time, such as 10 or twenty years.

This might give a tax benefit, particularly if you begin to make withdrawals when you remain in a lower tax bracket. Compounded growth: All interest that stays in the annuity also makes passion. This is called "substance" rate of interest. This development can proceed for as lengthy as you hold your annuity (topic to age restrictions). Surefire revenue: After the very first year, you can convert the amount in the annuity into a guaranteed stream of set earnings for a specified time period or even for the remainder of your life if you select.

Table of Contents

Latest Posts

Index Linked Annuity

Bailout Annuity

Keyword

More

Latest Posts

Index Linked Annuity

Bailout Annuity

Keyword